Our Technology

Flexibility, intelligence and individual advisory conversations

Thanks to our microservice-based architecture, all services are available to you either as stand-alone services or in combination. The interaction of our algorithms in the calculation kernel with graph databases enables intelligent digital conversations that take your advisory processes to the next level. By combining the microservices, we can cover many use cases and respond flexibly to your individual needs.

MODULAR MICROSERVICE ARCHITECTURE

FLEXIBILITY via APIs

All products (calculation algorithms and data) are also available to you as a single / modular web service. We rely on a modern RESTful architecture with JSON as exchange format.

The riskine API consists of various services such as: risk calculations, product prioritizations, coverage amounts, pension calculations and much more. Our question-answer process engine (POST /conversation/questions) can also be queried via our API. We also integrate third-party APIs and data into our microservices ecosystem.

INTELLIGENCE via data and algorithms

Behind our products are numerous microservices with algorithms and data that make advisory services more intelligent. Our products combine these microservices and bring them together in real time. This creates the best possible basis for your customers' decisions in a short time.

Examples are:

• Consulting algorithm that models individual customer recommendations

• Recommendations on coverage amounts

• Identification of customer risks

• Gap calculations

• Purchase probabilities

• Calculation of taxes and state pensions

• Sentiment Data

• Price calculations

The ADVISORY CONVERSATION is the main focus

riskine models digital advisory processes using graph databases. The next question results from the previous ones. The question texts as well as the answers are thus continuously adapted to the customer's needs (f.e. formality level of language, gender, hard or soft formulations, answer options, language, etc.).

These conversations are available via the microservice /conversation/questions, which is used in almost all our products. Additionally, we use NLU technologies in our chatbot.

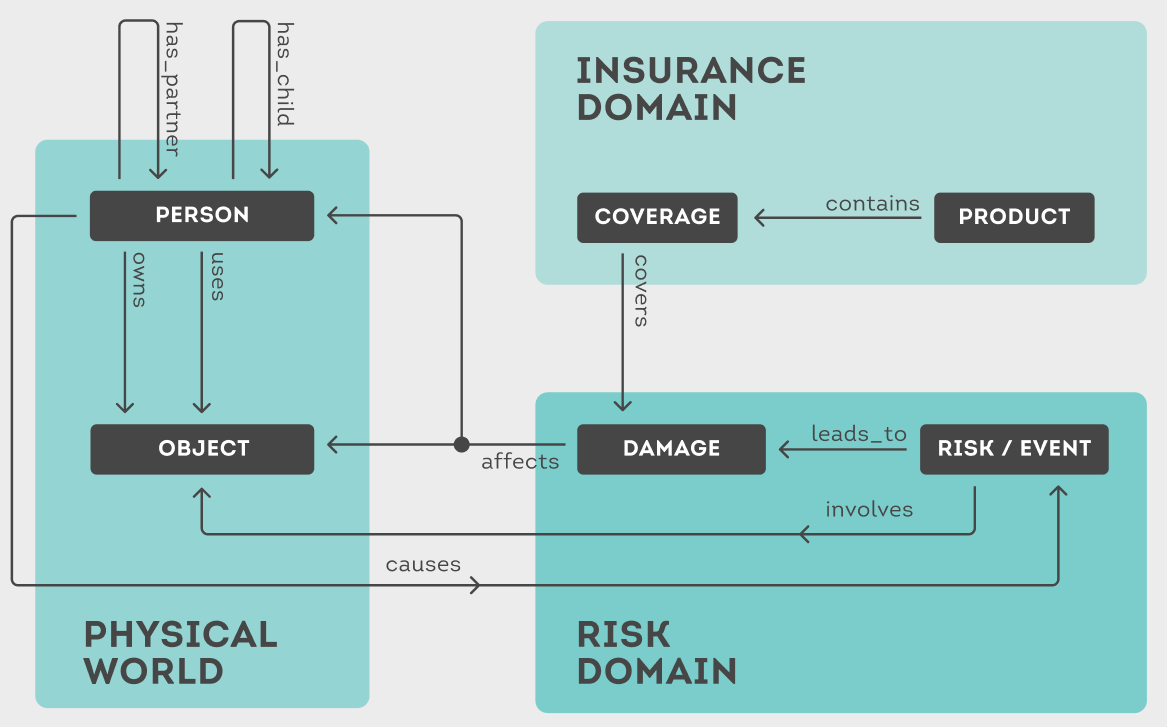

riskine ONTOLOGY

riskine has developed an open data model, the Open Insurance Ontology, which is used in its solutions. The model enables a global, standardized data architecture for insurance products with clearly defined classes, properties and relationships. The Ontology can be used across countries for all customer use cases (holistic advisory, pension/product advisory, tariff calculations, etc.) and is transparent as well as open. The schemes fulfill the following core characteristics:

• global - applicable in every country

• customer-centric - contains wishes, preferences and risks of your customers

• optimized for API usage and modern technologies

More about Open Insurance Technology

Advantages of our award-winning technology

Tech Stack